Salesforce and PayPal are the best customer relationship management (CRM) and multi-currency payment gateway worldwide. These days, PayPal is accepted for online purchases in over 200 countries and is used by millions of businesses worldwide.

This gives consumers and businesses the confidence to use their PayPal accounts for more significant transactions. Salesforce Commerce Cloud Optimization allows merchants to rank their products globally.

PayPal and Salesforce B2B Commerce Integration benefits can change the concept of transitions. Although salesforce commerce cloud development companies provide their services, you can find a Detailed Guide to Salesforce PayPal Integration in this article.

2 Simple methods of Salesforce PayPal Integration

You can hire a salesforce commerce cloud consultant or a Shopify store consultant to understand the Salesforce Commerce Cloud Implementation. We have explained 2 easy methods for you:

Method 1: Using PayPal Cartridge

Salesforce may be integrated without any hitches by using PayPal’s cartridge. This PayPal Integration with Salesforce Commerce Cloud combines functions to help e-commerce companies increase revenue and decrease overhead costs.

The most often used application programming interfaces (API) include:

- Express Checkout from Cart is supported by PayPal and PayPal Credit.

- Payment page PayPal Express Checkout

- IPN (Instant-Payment-Notification) (Instant-Payment-Notification)

- The sales process is simplified by tools like In-Context Checkout, PayPal One Touch, and various stand-alone API calls.

- Accept credit cards directly on your Salesforce using PayPal’s Website Payments Pro.

- Sales data synced to Salesforce mechanically.

Salesforce PayPal Integration makes it possible to log business conducted online within the cloud service instantly. This powerful tool integrates with PayPal sales and syncs them with Salesforce contacts, where new chances can be built. Store owners can attract more customers using Salesforce Commerce Cloud Optimization.

1- Initiate Immediate Payment Alerts with PayPal (Real-time Data Integration)

We can use instant payment notification (IPN) provided by PayPal and integrate with Salesforce using a Salesforce portal and an API built specifically for Salesforce Commerce Cloud. Modifying PayPal’s settings to enable Salesforce’s API connection.

2- Integrate PayPal with SF using the RESTful API:

Depending on how often the customer wants to sync such transactions, we will design and assemble a new Salesforce Apex batch class to PULL all of the transactions made at the PayPal account at a defined Interval.

A batch class must be written in salesforce to authorize PayPal’s connected app and retrieve the transaction at a predetermined interval. Create a schedulable class to control background tasks using Cron. Management of Refresh tokens via bespoke Apex code writing.

Method 2- Using Chargent, You Can Connect Your Salesforce Account with PayPal.

1. Chargent Installation and Configuration

- Install Chargent and configure it to work with Salesforce

- Set up Chargent following the instructions provided in the Quick Start Guide.

- If you’re using a version of Chargent before 5.57 and want to get started with PayPal Salesforce Integration via Payflow Pro, turn on the Remote Site Settings on the Salesforce website.

- To access settings, use the gear in the top right.

- Select Remote Site Settings Under the Security menu.

- Look for PayflowProAPI and then click the edit button.

- Mark the “Active” box.

- Click Save.

- Get the PayflowProTestAPI and do the same.

2. PayPal Payflow Pro For Salesforce B2B Commerce Integration

- In Salesforce, select the “app launcher” option in the upper left corner.

- See for gateways in the box labeled “Search for apps or products,”

- Press New. Select Payflow Pro as your Gateway Type.

Map the below-mentioned areas in Chargent to the Payflow Pro login information:

- Chargent Customer Reference shows Customer Login

- Chargent Merchant Security Key is the password

- Chargent Merchant Reference represents Partner ID from Payflow Pro

- Configure the ensuing Gateway fields.

- Select the Active checkbox to activate the Gateway.

- If you intend to use Payflow tokenization, use tokenization.

- Available Card Types – Choose your payment gateway from Visa Card, Debit card, Mastercard, or American Express.

- If you want to utilize tokens for more than 1 year, you need to click the PayFlow User Recurring Profiles option.

- Payment Options Accepted: Credit cards, direct debit, electronic checks, and e-checks are accepted.

- Accepted Currencies– This depends on your chosen payment gateway and the currencies they allow for transactions.

- Handling of Bank and Credit Card Data – This informs Chargent when to delete data from Salesforce. Four choices are available:

Four choices are available:

- Do not Clear Ever

- Remove when Successful Payment occurs

- Remove right After Complete Transactions

- Empty while Token is present.

- The following should also be configured while utilizing Payment Requests or Payment Console. A salesforce commerce cloud consultant can explain every step to you.

PR Transactions That Are Available

- Charge the whole amount immediately debit the credit card.

- Authorize Full Amount – It will hold all accessible funds until the card is charged, but it won’t actually charge the card.

- Authorize Minimum Amount—This choice will only hold the bare minimum that your gateway will permit—instead of charging the card. To record the transaction, you must charge the appropriate sum.

3. Adjust your Fraud Settings in PayPal.

PayPal’s test accounts are just as safe as their real-life counterparts since they apply the same. If you receive any error followed by the “Under Review by Fraud Service” message, it is possible that your Fraud Settings need to be adjusted before presenting test transactions.

- In the Service Settings menu and select Fraud Protection followed by Test Setup and Normalized Filtering Settings Edit.

- Make any necessary adjustments for beta testing and then hit Deploy.

- The maximum amount that can be spent in a single transaction can be changed in Account Settings > Transaction Limits.

Remember that your testing IP address may also need to be whitelisted.

- Select Fraud Protection under Service Preferences.

- Ordinary Filtering Lists Management

- Edit

- To save your IP address, click the “Add” button and then “Save.”

4. Integrating Payflow Pro from PayPal into Salesforce for Credit Card Testing

- To simulate a real-world purchase, simply create a new Chargent Order record and fill it up with fake information.

- Title of Account

- The amount to charge ($0-$1000 is suggested, while over $2,000 will be denied during evaluations).

- Mark the box for “Manual Charge”

- Details Regarding Payments:

- Date and Month of Expiration

- Date and Year of Expire

- Dates beyond the current year can be used in the Month/Year format.

The gateway field should be settled if more than one gateway record is active in Chargent. Whenever there are more than two available portals, you must choose one of them.

- If you’re happy with the changes, select Save.

- To add a payment to your freshly formed Salesforce order record, use the “Charge” button.

- This is where the CSC comes in (Card Security Code). For Visa, Mastercard, and Discover cards, this will be the last three digits of your card number, and for American Express, it will be the last four digits.

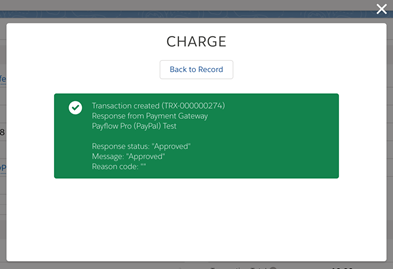

- An Approved notice will appear in a pop-up window.

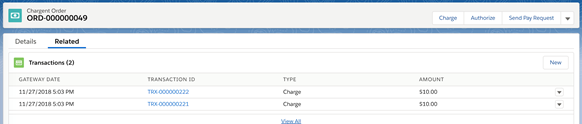

You may view the relevant Transactions—including the date, type, and amount—by clicking on Related after clicking Back to Record in the pop-up dialogue box.

After the successful installation of Chargent, the Test Endpoint option on the Gateway record will give you permission to switch between the live payment gateway and test environments.

Chargent’s Endpoint Override field allows you to input the production endpoint of your selected gateway, allowing you to transmit live transactions from a Salesforce Sandbox as the last step in testing.

- Please click on https://payflowpro.PayPal.com to access Chargent’s live PayFlow Pro integration:

In the Remote Site Settings, ensure the domain is present and provide the whole endpoint URL in the Endpoint Override area.

6. Tokenization for the Salesforce Payments Integration with PayPal

Chargent’s tokenization support for PayPal’s Payflow Pro gateway is unlike that of any other payment gateway integration. Payflow Pro utilizes Recurring Billing Profile IDs.

And Reference Transaction tokens.

A Reference Transaction token is the basic transaction ID you can use to propose a new payment transaction, and it expires after 12 months.

Tokens are submitted in place of confidential cardholder data, while PayFlow Pro automatically retrieves relevant payment details from past transactions.

If you use the Salesforce commerce cloud integration with PayPal, your recurring payment profiles will always stay.

Although this is the preferred method for processing regular charges against the consumer’s payment information, it does not endorse Authorization transactions.

When the Recurring Payment Profiles feature is active in PayPal Salesforce Integration, the Reference Transaction token is even required to submit Authorization payments.

7. To Configure Reference Transactions

The option to conduct Reference Transactions in PayPal Manager is turned off by default.

- The setting can be activated under Account Management > Transaction Settings

In Salesforce,

- Mark the “Use Tokenization” box shown present in the Chargent Gateway record.

- When you intend to make use of tokens for more than 1 year, click the PayFlow Use Recurring Profiles option available in the record of Chargent Gateway.

- Now set the credit card handling field.

- You can Choose Never Clear: The benefit of Chargent is that it won’t automatically delete any card information.

- Clear After A Successful Payment: In case, Chargent will only remove the card’s security code, credit card number, and expiration date following a successful charge.

- Clear Following Every Transaction: Any transaction will degrade the card security code, credit card number, and expiration date.

- Clear When Token present: All the credit card information is only removed when the token field shows a token.

Your initial payment follows the field value deletion of the Credit Card Number and the storage of the token for further charges. The Reference Transaction will save in the Token domain following a successful transaction. The Customer Token field will be used to store PayPal’s Profile ID. This hectic process is made easy and quick with Salesforce Commerce Cloud Support.

8. Field Mapping for PayPal and Salesforce Integration

Here are examples of mapped fields from Chargent to the PayPal/Salesforce Commerce Cloud Implementation.

- Gateway ID in salesforce < Transaction ID in PayPal

- Authorization In Salesforce < Authorization Code in PayPal

- Invoice Number in Salesforce > Supplier Reference No. in PayPal

- Order Information In Salesforce > Comment 2 in PayPal

- Salesforce Record ID > PayPalCustomer Code

In the Salesforce Commerce Cloud Migration case, you can quickly transfer customer data.

8 Benefits of Salesforce PayPal Integration

Here are the following benefits of Salesforce PayPal integration:

1. Get Paid Faster

Salesforce commerce cloud integration with PayPal creates a funnel that collects payments from various channels into a single hub. Even though the Salesforce database is crucial in processing payments, accepting payments using Salesforce is simplified.

The integration would eliminate the need for separate gateways and allow you to quickly match the receipt with the client, creating a more streamlined process of transferring money and keeping accurate records.

2. Gaining Financial Command

Your ability to accept payments and tailor your payment methods to your clients’ evolving preferences is greatly enhanced by Salesforce PayPal integration. If your payment is due at regular intervals, you can implement a recurring payment model or arrange the payments in any other way that suits your needs. A custom proprietary billing system or virtual terminal interface can also be implemented.

3. Get Confidential Data In A Safe Way

Within salesforce commerce cloud development; your team can check real-time PayPal customer data, such as PayPal payments and payment methods like bank account transfers, credit cards, and debit cards, In addition, sensitive information is never transmitted outside of PayPal, and all PayPal payment methods are PCI compliant.

If you plan for Salesforce Commerce Cloud Migration, all the information will be shifted to the new store efficiently.

4. In-depth Knowledge of your Customers.

Salesforce B2B Commerce Integration with PayPal will allow you to see your consumers from any angle because you can monitor the total amount spent by each consumer and their purchasing history. You can also determine facts such as their denied payments, refunds, accounts standing, and booked orders.

5. Obtain Updated Data Instantaneously

Data from PayPal can be imported into Salesforce, thanks to Salesforce Commerce Cloud Support. With this feature, you can integrate real-time data from PayPal analytics into user-friendly dashboards and reports that can be imported directly into Salesforce. Your team can now easily match your customers’ payment information in Salesforce.

6. Improve Data Transparency & Efficiency

All PayPal transactions are now viewable in Salesforce as native data displayed user-friendly and straightforwardly. With Salesforce Commerce Cloud Support, the client’s PayPal payment information is synced with Salesforce in real-time, keeping your team informed at all times.

In addition, they can monitor the development of these PayPal payment transactions to set off triggers, thus automating a sequence of operations in Salesforce.

7. Enhance Accuracy through Automation

The time and effort it takes to track payments manually will eventually catch up with you. Because of this, you may process and record payments with greater precision using the automation provided by the Salesforce PayPal integration.

In PayPal and Salesforce Commerce Cloud Implementation, there is no room for data duplication because all of your data is always being monitored. For instance, the system can immediately associate a completed payment with the relevant lead and log the transaction in the database, greatly minimizing the likelihood of human error while ensuring a smooth flow of funds.

8. Constable Safety

Security is paramount while sending or receiving money. In and of itself, cutting out the middleman greatly reduces the likelihood that your clients’ private information will get into the wrong hands.

Salesforce commerce cloud development team, administrators, and operators are already well-prepared to guarantee customer data privacy. Additionally, PayPal uses a process called “tokenization,” in which sensitive data such as credit card details are exchanged for unique digital “tokens” instead of being stored locally.

This greatly reduces the risk of a data breach because all of the sensitive data is stored securely with the processor. Salesforce also allows you for Salesforce Commerce Cloud Migration and all the information.

FAQs

Is it Profitable to Integrate Salesforce Commerce Cloud with PayPal?

Using both PayPal and Salesforce may streamline your payment sending and receiving by integrating the two systems. It provides a centralized location for both taking in payments from clients and sending payments to suppliers.

The integration also syncs financial transactions with your Salesforce account, so you can easily monitor the money coming in and out of your business. With Salesforce Commerce Cloud Optimization, you can make the most out of this connection with Salesforce Commerce Cloud Optimization.

Is our data kept private in PayPal Salesforce commerce cloud integration?

Payments sent and received through the Salesforce PayPal interface are guaranteed to be safe. Both systems employ a multilayer security architecture to protect user data from prying eyes, leaks, and fraud via methods including data encryption.

Which Salesforce Product is the Best Option for this Integration?

While the Salesforce PayPal integration works with all Salesforce products, it is most useful for customers of the Salesforce B2C Commerce Cloud (or B2B) who wish to accept payments and keep track of sales from many channels.

Conclusion

Briefly, the advantages of such integration semantics can be used to your benefit. It can be done by putting into place the necessary mechanism for ensuring the integrity and convenience of all financial transactions.

This article detailed the process of Salesforce PayPal Integration. Nonetheless, you can hire a salesforce commerce cloud consultant to give you a one-to-one understanding.

![How To Choose a Salesforce Commerce Cloud Payment Gateway [2026 Guide]](https://ecommerce.folio3.com/blog/wp-content/uploads/2022/09/salesforce-commerce-cloud-payment-gateway.webp)