Centralize billing and payment visibility by linking Shopify QuickBooks for account level purchasing. Support governed invoicing, credit terms, and refunds with structured approvals and posting, beyond basic order exports flows.

Orders captured in Shopify often require invoices, deposits, or partial shipments that accounting teams finalize later, creating mismatched totals, taxes, and payment status across customer records.

Tax rules applied at checkout can differ from jurisdiction codes used in QuickBooks, so reporting splits by state, customer exemption, or product class become unreliable.

B2B buyers pay by card, ACH, or terms, but settlement, fees, and refunds must hit the correct QuickBooks accounts, classes, and locations for accurate cash reporting.

Company purchasing needs net terms, credit limits, and invoice delivery preferences that live in accounting, yet Shopify must enforce them during ordering and reorders across locations.

Explore our portfolio of Shopify solutions that’ve helped many eCommerce brands boost conversion and engagement rates.

Keep orders, invoices, and payments consistent across teams.

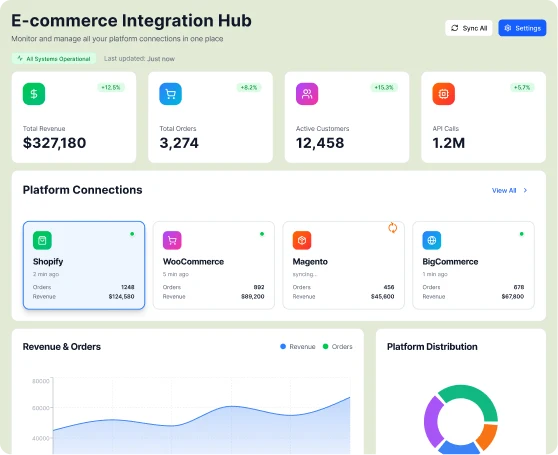

Deliver a controlled integration layer that translates Shopify transactions into QuickBooks ready accounting events, with logging, retries, and audit trails. Finance teams get dependable posting, while commerce teams keep speed without compromising invoice accuracy for each account, location, and type.

Surface invoice status, balances due, and credit utilization inside Shopify company accounts by reflecting QuickBooks receivables. Sales reps can confirm who can buy on terms, finance can monitor exposure, and buyers receive accurate statements tied to purchase orders each cycle.

Maintain consistent item, SKU, and category mappings so QuickBooks reporting matches what buyers see in Shopify catalogs. When products change, updates flow with guardrails, keeping revenue recognition, class tracking, and inventory valuation aligned across locations for close accuracy every month.

Track refunds, credits, and chargebacks as structured adjustments that preserve original invoice references in QuickBooks. Shopify teams can issue customer credits, while accounting keeps a traceable record of reversals, fee impacts, and net cash movement by account and location rollups.

QuickBooks remains the system of record for chart of accounts, invoices, payments, and tax reporting. Shopify holds buyer facing product, company, and ordering context. We align identifiers so transactions are traceable across both environments consistently.

We choose which entities push from Shopify to QuickBooks and which return, then define triggers such as account approval, order submission, delivery confirmation, or settlement. Timing stays event driven for statuses and batched for postings.

When totals, tax, or customer records diverge, we route exceptions to review queues instead of overwriting finance data. Credit terms, discounts, and price lists remain governed, while Shopify displays prices and payment expectations per company.

Sync customer identifiers, company locations, and billing contacts so Shopify account activity references the right QuickBooks customer records. Updates are controlled, with QuickBooks owning legal names, addresses, and terms always.

Translate approved Shopify B2B orders into QuickBooks invoices or sales receipts, carrying PO numbers, shipping charges, and tax lines. Posting can wait for fulfillment, deposit capture, or finance release events.

Sync settlement summaries, refunds, and credit memos with mapped accounts. Detailed gateway payouts or bank reconciliation do not originate in Shopify; they remain managed in QuickBooks and require finance governance.

Discovery

Mapping

Workflow Design

B2B Testing

Cutover

Stabilization

We have been working with Folio3 since 2018. We are extremely fortunate to have found such a fantastic team of people. They are professional, organized, time-sensitive, and their work is stellar. Most recently, we needed support with dynamic schema mark-up and GA4 event integrations.

![]()

As you know our project is quite complicated & involves some fairly intricate customizations. Overall we are very happy with the progress so far. We feel that your team understands our requirements very well & also anticipates issues & provides effective solutions.

![]()

The Folio3 team is a pleasure to work with. During the project, they were responsive and their turnaround time was always stellar.

![]()

Yes, Shopify can integrate with QuickBooks, but B2B teams typically need more than a basic transaction export. The real requirement is governing invoices, terms, credits, taxes, and payment application across systems through a defined accounting architecture, not a connector.

QuickBooks remains the authority for payment terms, credit limits, and invoice preferences, while Shopify enforces those rules during company purchasing. When limits change, account eligibility updates without manual holds or spreadsheet based approvals.

B2B orders often require invoices with PO numbers, negotiated pricing, freight lines, and compliant tax handling. The integration creates invoices from approved order states and reflects invoice status back to buyer portals across locations.

Payments arrive through cards, ACH, or on-account remittances and must be applied correctly in QuickBooks. The integration posts settlements to clearing accounts, maps fees, and records refunds or credits with original invoice references.

Shared identifiers connect Shopify companies, locations, and contacts to corresponding QuickBooks customers. Product SKUs map to QuickBooks items and reporting dimensions, with validation preventing duplicates when ownership shifts between teams.

When an approved B2B order is submitted, Shopify provides pricing and context while the integration converts it into a QuickBooks invoice or sales receipt, carrying PO numbers, discounts, freight, and tax lines for governed posting.

QuickBooks remains the source for invoice numbers, balances, and payment application. Statuses return to Shopify for buyer visibility, while mismatches in totals, tax, or customer mapping are flagged for finance review.

QuickBooks accounting policy defines what can be posted and how it must be categorized, and Shopify cannot replace that governance. Tax allocation, rounding, clearing accounts, and entity mapping must be standardized or reporting will fragment.

QuickBooks can remain the authority for terms and accounting policy, while Shopify uses approved prices for buyer facing catalogs. Taxes and discounts must be mapped so QuickBooks reporting reflects the same logic used for invoicing.

Yes, when designed for B2B, the integration can carry PO numbers from Shopify into QuickBooks invoices and return invoice identifiers and balances to the buyer account experience, keeping communications consistent.

Company locations in Shopify can be mapped to the correct QuickBooks customer records and, when needed, to classes or locations for reporting. The key is consistent identifiers so postings land in the right entity.

QuickBooks should remain the system of record for invoices, receivables, and payment application. Shopify acts as the commerce layer that captures ordering context and shows status back to account users.

Access should be scoped by roles and least privilege, with clear separation between commerce users and accounting permissions. Integration credentials, logs, and exception queues should be governed so only authorized teams can view or approve sensitive financial updates.

Send in your details to get instant access to our calendar and book a convenient slot.

Please ensure to send sufficient details about your project so our experts can provide you the most value in the free consultation.

3080 Yonge Street, Suite 6060, Toronto, Ontario M4N 3N1

Amado Nervo #2200, Edificio Esfera 1 piso 4, Col. Jardines del Sol, CP. 45050, Zapopan, Jalisco, Mexico

C/- Prime Partners Level 4 1 James Place, NORTH SYDNEY New South Wales 2060

160 Bovet Road, Suite # 101, San Mateo,

CA 94402 USA

6701 Koll Center Parkway, #250 Pleasanton, CA 94566

Tel: +1 (408) 412-3813

Export House, Cawsey Way, Woking, Surrey, GU21 6QX

Tel: +44 (0) 14 8339 7625

Folio3 FZ LLC, UAE, Dubai Internet City,

1st Floor, Building Number 14, Premises 105, Dubai, UAE

Tel: +971 04 2505173

49 Bacho Kiro Street, Sofia 1000, Bulgaria

Folio3 Pvt. Ltd, Folio3 Tower, Plot 26, Block B,

SMCH Society, Main Shahrah-e-Faisal, Karachi.

Tel: +92-21-3432 3721-4

First Floor, Blue Mall 8-R, MM Alam Road Gulberg III, Lahore

Corporate 7 by Maaksons, Executive Block, Civic Center 1, Gulberg Green, Islamabad

Tel: 0333 5657425

Set up your Shopify MCP with Folio3.