What Are Shopify Transaction Fees and How does Shopify take a percentage of sales?

If you use the payment processor of Shopify, you do not need to worry about the processing fees. However, if you are choosing an option like Authrorize.net and PayPal, you should be prepared for paying fees somewhere around 3% + 30¢ on each of your transactions. Additionally, you also have to pay some kind of fees on your turnover, and that can range from 0.5 percent to 2 percent.

Transaction fees and rates of credit cards are very annoying parts of sales channel implementation or solution of point of sale into your online business. Usually, ass owners of stores would make a great number of sales and boost their monthly revenue without even paying a single penny. Sadly, all eCommerce platforms and checkout tools will be charging you at least some sort of basic fee for credit card payments and transactions.

Read More: CBD Payment Processor Shopify

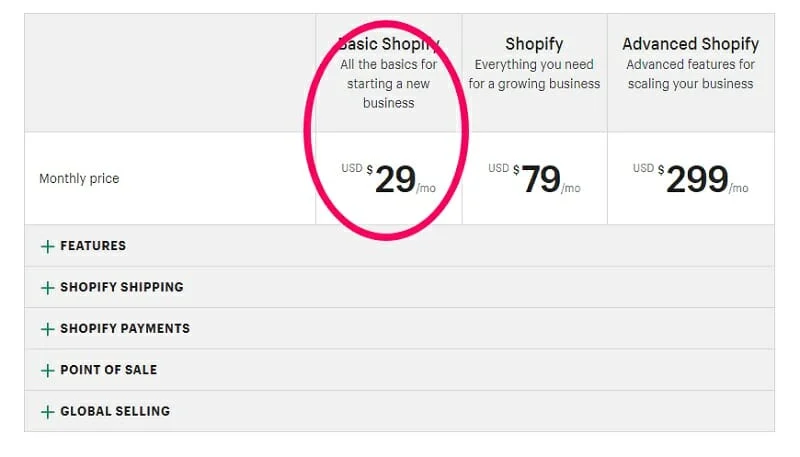

Shopify transaction fees and other costs of using Shopify will be depending on what Shopify plan are you using. Such as:

How much does Shopify take per Sale for Basic Shopify Plan

Basic Shopify – It is available at only $29/month. It is the basic solution available for store owners, and it features everything that is much required to launch your business as soon as possible. This basic plan will require you to pay 2.9 percent of transaction fees along with 30 cents on each purchase. This can be considered as the highest price offered by Shopify.

Read Also: How To Choose A High-Risk Payment Processor For Your Shopify Store?

What Percentage does Shopify take for Shopify Plan:

Shopify – This is the standard plan for Shopify, and it costs around $79 monthly. However, it features different rates of credit cards. In order to receive credit card payments using this plan, you will have to pay 2.6 percent and 30 cents on each transaction.

How do You Get Paid from Shopify?

Shopify pays to selected countries. You need to first check if Shopify payment is enabled for your region or not. Shopify Payments is the simplest method of being paid online.

As the Shopify payment system is integrated you can view your payment and several options related to it without any hassle.

Read Also Shopify Singapore Pricing

Shopify also supports some accelerated checkouts which are specific to it; for example, Apple Pay, Google Pay, Shop Pay, and others support specific accelerated checkout systems which become quite convenient for the customer and involves no third-party payment options.

How much does Shopify Charge per Transaction for Advanced Shopify

Advanced Shopify – Lastly, Shopify Advance offers the highest prices that the brand offers. However, the transaction rates of this plan are the lowest. The transaction fees, when using Shopify Advance, will be around 2.4 percent and 30 cents on every transaction.

Simply to say, the more you are paying for your point of sale solution and Shopify app, the less you will have to pay for each of your transactions. It means that users are worried about paying for all things from rates of shipping to rates of credit cards when you are selling a lot on your e-commerce store, it would be much better to upgrade the plan and shift to Shopify Advance for payment processing.

Indeed, the Advance plan of Shopify offers additional features such as full customization for your channels of sales, social media integrations, support for high sales, advanced reporting, etc. But there is s downside to it. It is not available in all countries. However, the list of countries that are supported by Shopify are:

- Australia

- Austria

- New Zealand

- Singapore

- Spain

- Sweden

- United Kingdom

- Canada

- Denmark

- Germany

- Hong Kong SAR China

- Ireland

- Italy

- Japan

- The Netherlands

- United States of America (Shopify Payments are not available to territories of US except Puerto Rico.)

If you are using a third-party payment gateway, you will have to pay a 2.0 percent transaction fee on your every sale.

Read Also: How to Sell Shirts Online without Inventory Using Shopify?

How Do Transaction Fees Work?

Every time a customer makes a purchase from you, i.e., a transaction, you will have to pay certain transaction fees depending on the Shopify pricing plan that you have subscribed to. The fee rates are as follows: 2 percent for Shopify Basic Plan, 1 percent for Standard Shopify Plan, however, 0.5 percent for the Advanced Shopify plan.

What Are Transaction Fees For?

Transaction fees are pre-defined charges that store owners are required to pay on each of their transactions if you are using a third-party payment gateway for receiving payments from your customers. This fee is supposed to cover the charges for the e-commerce brand (Shopify) to integrate with third-party payment providers.

Just like the rates of credit cards, transaction fees are different for each of Shopify’s plans. However, you can avoid paying these fees only if you activate Shopify payments that is Shopify’s own payment gateway.

Doesn’t The Monthly Plan Fee Cover This Already?

No, and yes. The monthly subscription fee primarily provides you access to the Platform, ie. Shopify and its selling tools in order to get your e-commerce store up and working. The transaction fee is supposed to power your store continuously. However, you only have to pay this fee whenever a customer makes a purchase from you.

Read Also Shopify Payment Gateways

What Are The Transaction Fee According To Shopify Plans?

Basic Shopify Plan Transaction Fees

The basic plans feature an amazing range of options and enable users to do everything that is required to build an e-commerce store. It brings a discount code engine along with it. Moreover, you can upload unlimited products on your store. The best thing is that you get fraud analysis tools in this plan. You obtain a completely functional blog and a website via Shopify. Hence, all of your orders and products are managed via Shopify. You do not need a separate website to get things done.

You also get SSL certificate shipping labels, manual order creation, and 24/7 supports and unlimited file storage.

This plan is available at $29/ month along with 2.9 percent and 30 cents transaction fees. It is higher than the charges of the lite plan. However, you get the freedom to level up your store with a huge variety of products.

For Who This Pricing Plan Is Suitable?

If you want to create a functional and beautiful online store, but you are worried about paying for extra features in a higher pricing plan, this might be your best choice. This plan is best if you already own a website. You can pair it with the Shopify Lite plan.

Shopify Plan Transaction Fees

It has been considered as the most popular solution for most Shopify users. This plan is available at $79 per month, along with a 2.6 percent and 30 cents transaction fee. It not only sounds good, but it is actually is good!

You get all the best features that Shopify has to offers. You can upload an unlimited number of products and take the benefit of everything that comes with this plan. Moreover, you have access to Shopify POS, abandoned cart recovery, professional reports, and gift cards.

The abandoned cart recovery tool is one of the main reasons why people go for this pricing plan. You can grab the contact information of your customers who leave their orders in between.

It allows you to contact the person who showed some sort of interest in your products for prompting a purchase. Moreover, abandoned cart tools automatically send out emails. For instance, if users leave a purchase in the middle without completing it, you can message them as a reminder within six hours.

For Who This Pricing Plan Is Suitable?

This plan is suitable for companies who wish to level up their scales faster than usual. As this pricing plan allows the uploading of unlimited products and provides unlimited storage, you can enjoy fair benefits at a justifiable price. If you manage to bring in $5,000 each month, the Shopify Plan is best for you as the transaction fees are lowered when the volume of sales increases, using third party payment gateways.

Advance Shopify Plan Transaction Fees

This plan is available at $299/month along with 2.4 percent and 30 cents transaction fees that enable you to enjoy all features included in the plans mentioned above. However, you get access to an advance report builder, and external calculate shipping rates. Nevertheless, you get unlimited product uploads in this plan as well. Also, the transaction fees will decrease a bit when you use external payment gateways.

One good thing about Shopify Advanced Pricing Plan is that all things are unlimited. As a result, the capabilities of your storage are endless. You are free to upload as many products as you want and post as many images and videos as you like. You also get access to the abandoned cart recovery feature that ensures you reach your sales goals.

Another important thing is that you can provide access to your dashboard to fifteen users at most. Shopify shipping discount is the perfect you can find as compared to the other plans.

For Who This Pricing Plan Is Suitable?

This plan is perfect for companies who prefer to get their shipping handled by an external service provider. Also, high revenue companies can choose this plan as it offers advanced reports that allow for projecting and testing. If your company is able to make $10,000 each month, your transaction feel will be lowered, and you will get Shopify shipping discounts.

Is Using Shopify Payments Going To Save Me More Money Compared To Using Other Similar E-Commerce Builders?

Yes. If you are using BigCommerce, you are forced to upgrade your plan when you manage to exceed a certain level of sales. Shopify will never ask you t do so. It means that you are able to sell products worth one million dollars. Also, you can stay subscribed to the lowest plan of Shopify at $29/month.

If you are using Volusion, you get a limited bandwidth amount, and if you exceed it, you are forced to purchase it from them, whereas Shopify offers unlimited bandwidth.

Shopify vs. Bigcommerce

One big question that most users of Bigcommerce and Shopify would like to ask is:

What Bigcommerce or Shopify’s cut of my sales? i.e., what is the transaction fee going to be?

In this regard, BigCommerce appears to take the crown by all means as it charges 0 percent transaction fees on all of its plans.

Shopify does the same, but only when you are using the Shopify Payments system for processing card transactions and not using any third-party payment gateway.

IIf you do not use Shopify Payments, you will have to pay the transaction fees, which varies according to the plan you are using.

Moreover, there are a bunch of countries where Shopify Payments does not work (list mentioned above). If you live in one of those countries, the only option you have is to choose an external payment gateway for receiving payments and pay the transaction fee.

But the downside to sing BigComemrce is that if you cross a certain level of sales, they will ask you to upgrade your plan, which means you will have to pay more monthly subscription fee. Whereas, with Shopify, you do not have to upgrade your plan as there are no limits.

Shopify vs. Magento

Shopify charges transaction fees for using external payment gateways like Authorize.net, Braintree, and Paypal. The fee percentage ranges from 2.0 percent to 0.5 percent, along with monthly subscription fees. Each time a customer makes a purchase from you, Shopify takes a cut. Users can avoid paying the transaction fee by using Shopify Payments.

Magento 2 offers its users with a completely free community edition and requires them to pay a cost depending on the size and needs of an e-commerce store. It makes Magento 2 a perfect solution for every e-commerce business. However, for Magento, users will have to buy a hosting solution that comes at $1000 to $2000 monthly as this e-commerce platform is self-hosted.

Shopify charges a certain fee per purchase, whereas Magento does not. If you choose Magento, you will be required to pay the payment processors only.

WooCommerce vs. Shopify

When you attempt to sell online, you must have to add payment gateways for your customers in order to receive payments. Both Shopify and woocommerce provide you a choice of more than a hundred payment gateways.

These are either added via both woocommerce and Shopify integrations or are built-in. Some of the main ones are as follows:

- PayPal (Read More: PayPal Shopify Integration)

- Stripe

- Credit and debit cards

- Apple Pay

- Square

All payment gateways come with different transaction fees. You need to make sure that you check before choosing one.

Shopify charges 2 percent on each transaction if you are using a third-party payment gateway. Users can minimize these fees by upgrading your pricing plan. Also, you can get rid of it completely by opting to use Shopify Payments.

One major advantage of woo-commerce is that it never charges any transaction fees if you are using any third-party payment gateway, i.e., non-woo-commerce payment gateway.

With woo-commerce, you will still have to pay bank charges along with charges from your payment provider. If users are selling a good number of products, woo-commerce is a better choice. It also attracts sellers who plan on choosing their merchant account.

Ecwid vs. Shopify

A payment gateway processes transactions of your customers securely. Various companies offer payment gateway services, some of which are PayPal, Worldpay, and Stripe.

Shopify and Ecwid work with a large range of payment gateways, around 100 in Shopify’s case, and 70 in Ecwid’s case.

As we have already discussed that Shopify has its own payment gateway as well that is known as Shopify Payment. It is very simple to set up, and using it allows you to avoid paying a transaction fee that you must have to pay when you use external payment gateways.

However, you can only use Shopify payments if you are from a certain set of countries (the list is mentioned above). If you are not from one of them, you cannot use Shopify Payments as so it is a must for you to use a third party payment gateway. It means you will have to pay a transaction fee that varies from 0.5 percent to 2 percent that depends on the pricing plan you are using.

Using Ecwid, you are enabled to use third party payment gateways for processing transactions. Moreover, you will not have to pay for doing so. Nevertheless, you will have to invest some time in configuring your selected payment gateway.

Wix vs. Shopify

No doubt Shopify eCommerce web development is so great but both Wix and Shopify charge quite similar when it comes to paying transaction fees when using their own built-in payment processors. Wix charges 2.9 percent, and Shopify charges 2.4 percent.

Moreover, Shopify cuts a percentage of your sales if you choose to utilize a third party payment gateway. This fee varies from 0.5 percent to 2.0 percent according to your selected pricing plan.

The only problem is the unavailability of Shopify Payments in some countries. People living in those countries only have the choice to choose third party payment gateways, and they end up paying a large sum of money as a transaction fee.

Wix never charges its users for using any external payment gateway, and so Wix is the winner in this regard.

However, for selling products on Wix, you must have to be on either a VIP plan or an eCommerce development plan. Both of them are expensive. Bear in mind. You must have to pay a percentage on each transaction to your selected payment gateway provider. All of them charge different rates.

Shopify Where Do I See Credit Card Transaction Fees?

Here are the steps:

- From Shopify admin, go to ‘settings.’

- Click ‘billing.’

- Select the bill you want to see in the billing section.

- If a bill involves transaction fees, the transaction fees section will include links to the related order. Click them to see the information.

- In the panel, you can easily view the transaction fee details for each of your order that is covered by this bill.

- Select an order to see the full transaction details.

How To Categorize Shopify Transaction Fees In Quickbooks?

Follow these steps:

- Open ‘Expense’ appearing on the left menu.

- Go to the ‘Expenses tab.’

- Click New transaction

- Choose Expense

- Fill in all the necessary details such as payment date, payment account, Payee, and the Category details section.

- Click ‘Save’ and close.

How Do I View Monthly Shopify Transaction Fees?

- Go to the Shopify admin and open settings.

- Select the ‘billing’ option.

- Open the bill you want to see in the ‘bills’ section.

- If any bill includes transaction fees, the transaction fees section will include links to the order that are associated.

- Click to open the one you want to see.

- In the opening panel, you can check the details of your transaction fee for all of your orders covered by that bill.

- Select an order to check its full details of the transaction.

How To Avoid Shopify Transaction Fees?

The only option you can choose in order to avoid paying transaction fees is to use Shopify Payments that is Shopify’s own payment gateway.

Shopify Transaction Fees If I Use a Third-Party Payment Gateway?

If you are using a third-party payment gateway, you will have to pay a 2.0 percent transaction fee on your every sale along with whatever charges you have to pay to your payment gateway provider.

Does Shopify Charge Transaction Fee For Shipping?

Shopify has three pricing plans:

Shopify Basic Plan – It costs around $29/month, along with a 2.9 percent plus 30 cents on each transaction.

Standard Shopify Plan – It costs around $70/month, along with a 2.6 percent plus 30 cents on each transaction.

Shopify Advanced Plan – It is available at $299/month, along with 2.4 percent and 30 cents on each transaction.

FAQs

How much of a cut does Shopify take?

Shopify’s cut includes subscription fees starting at $39/month, plus a transaction fee of 2.9% + 30¢ per online sale on Basic plans. Additional fees apply if not using Shopify Payments.

Does Shopify take a transaction fee?

Yes, Shopify charges a transaction fee of 2.9% + 30¢ per online transaction on the Basic plan. Fees decrease with higher plans. If not using Shopify Payments, an extra fee of up to 2% applies.

How to avoid Shopify transaction fees?

Use Shopify Payments as your payment processor. This eliminates the additional transaction fees of up to 2% charged when using external payment gateways like PayPal or Stripe.

What is the payout fee for Shopify Payments?

Shopify Payments doesn’t have a payout fee but includes standard processing fees: 2.9% + 30¢ per transaction on Basic. Fees lower with higher plans: 2.6% + 30¢ on Shopify, 2.4% + 30¢ on Advanced.

Does Shopify take a cut of your profits?

Shopify doesn’t take a direct cut of profits. It charges subscription fees and transaction fees per sale. Using Shopify Payments avoids extra fees for using third-party payment gateways.